Oil prices edged lower in quiet Christmas Eve trade in Asia Tuesday as dealers engaged in profit-taking, with a lack of leads to spur fresh market movement, AFP reports according to analysts. New York's main contract, West Texas Intermediate (WTI) for February delivery, was down 23 cents at $98.68 in afternoon trade while Brent North Sea crude for February eased two cents to $111.54. "There hasn't been much movement in the commodity or currency markets ahead of the holidays, and traders are currently squaring off their positions," Ric Spooner, chief market analyst at CMC Markets in Sydney, told AFP. "We are seeing some profit-taking with the WTI contract after the rally last week," he said. US oil prices rose 2.8 percent last week following upbeat economic data as well as an announcement by the Federal Reserve that it would cut its stimulus by $10 billion to $75 billion a month from January, indicating its confidence in the economy. Singapore-based Phillip Futures said oil prices retained firm support owing to buoyant sentiment about US demand, while supplies continue to be curtailed from OPEC members Libya and Iran. Output from Libya has been hit by a months-long blockade of critical oil-exporting terminals, while Iranian exports have been halved to 1.2 million barrels per day following crippling international sanctions imposed on it because of its disputed nuclear programme. Phillip Futures said data from the US Commodities Futures Trading Commission showed that investors including hedge funds and pension funds had increased their "long positions" on crude oil in the week to December 17, "reflecting positive sentiments towards the commodity".

Oil prices edged lower in quiet Christmas Eve trade in Asia Tuesday as dealers engaged in profit-taking, with a lack of leads to spur fresh market movement, AFP reports according to analysts.

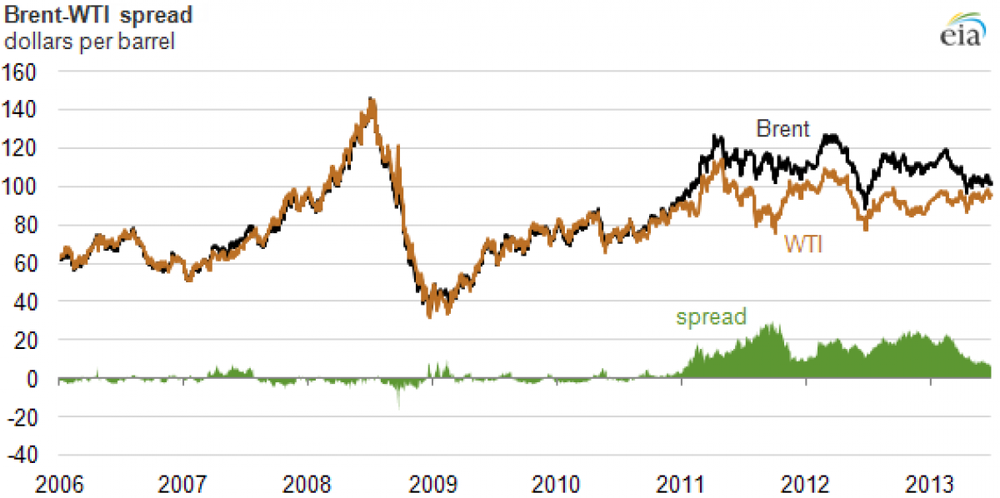

New York's main contract, West Texas Intermediate (WTI) for February delivery, was down 23 cents at $98.68 in afternoon trade while Brent North Sea crude for February eased two cents to $111.54.

"There hasn't been much movement in the commodity or currency markets ahead of the holidays, and traders are currently squaring off their positions," Ric Spooner, chief market analyst at CMC Markets in Sydney, told AFP.

"We are seeing some profit-taking with the WTI contract after the rally last week," he said.

US oil prices rose 2.8 percent last week following upbeat economic data as well as an announcement by the Federal Reserve that it would cut its stimulus by $10 billion to $75 billion a month from January, indicating its confidence in the economy.

Singapore-based Phillip Futures said oil prices retained firm support owing to buoyant sentiment about US demand, while supplies continue to be curtailed from OPEC members Libya and Iran.

Output from Libya has been hit by a months-long blockade of critical oil-exporting terminals, while Iranian exports have been halved to 1.2 million barrels per day following crippling international sanctions imposed on it because of its disputed nuclear programme.

Phillip Futures said data from the US Commodities Futures Trading Commission showed that investors including hedge funds and pension funds had increased their "long positions" on crude oil in the week to December 17, "reflecting positive sentiments towards the commodity".

+7 (777) 001 44 99

+7 (777) 001 44 99

Қазақша

Қазақша Русский

Русский English

English