Kazakhstan has been put on the map of the world's riskiest sovereign debt by Bank of America Merrill Lynch, Tengrinews reports citing Business Insider UK.

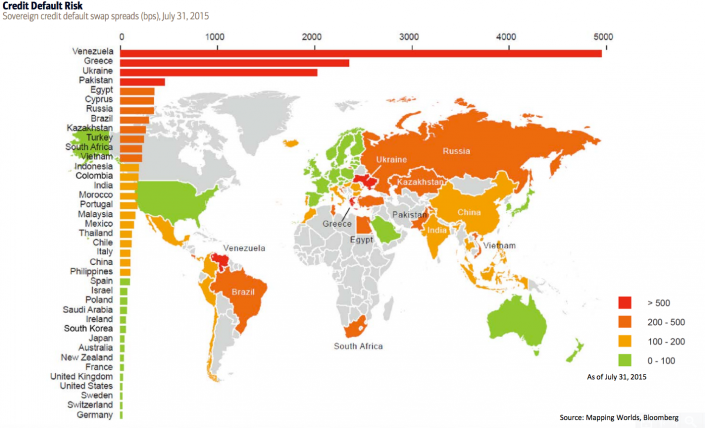

Bank of America released a number of maps under the title of Transforming World Atlas. The Credit Default Risk map is based on prices of the country's credit default swaps (CDS), the derivatives that pay out only if the borrower defaults.

The charts looks colorful and being placed 9th and in the red looks dangerous. However since CDS is the ground for the map it takes some numbers to understand how bad or good things really are.

Kazakhstan's government debt makes 22.9 billion dollars. And its Debt to GDP makes 12.86%. This is small compared to most countries. For instance, USA Debt to GDP is 103%, Japan's is 230%, France - 95%, Germany - 74.7%, the UK - 89.4% according to Trading Economics. But as you can see most of these countries are doing well and in green on the chart. Why the irrationality? Why is Kazakhstan with its tiny debt in the top 10?

The rating considers the sovereign credit default swaps as a type of insurance in case sovereign governments do not pay back their debts. Ideally the price of the “insurance” should depend on the likelihood of the actual event taking place – the higher the price, the higher the likelihood. However in practice the derivative have long lost its true correlation with real numbers and has become a speculative financial instrument reflective of general trends, overall performances, trust or distrust to governments, political anticipations and multitudes of other factors that have little to no connection with the size of the dept, the country's GDP and other objective factors. Kazakhstan is a very good example of this phenomenon.

The thing is that Kazakhstan, with its almost nonexistent government debt and sound Debt to GDP ratio, has 386 million net ($7.6 billion gross) notional CDS outstanding, according to DTCC Market Data.

The irrationality emerges because one can buy credit default swaps on a debt that doesn't even exist, or in case of Kazakhstan, on the tiny sovereign debt of 22.9 billion that is highly unlikely to be defaulted on simply because it is so small.

The red Top 10 includes Venezuela (1st), Greece (2), Ukraine (3), Pakistan (4), Egypt (5), Cyprus (6), Russia (7), Brazil (8), Kazakhstan (9) and Turkey (10).

On the opposite side of the rating, Bank of America listed Germany, Switzerland, Sweden, the USA, the UK, France, New Zealand, Australia, Japan, South Korea, Ireland, Saudi Arabia, Poland, Israel and Spain.

By Tatyana Kuzmina and Guyzel Kamalova