Global mining giant BHP Billiton has outlined plans to slash capital spending by almost a fifth, with new chief executive Andrew Mackenzie warning the brakes could be applied even further, AFP reports. The world's biggest miner has seen profits hit by weak commodity prices and cool Chinese demand and in his first major address since taking over from Marius Kloppers, Mackenzie outlined a conservative approach. He said capital and exploration expenditure for the 2013/14 financial year would be cut to US$18 billion, from a peak of US$22 billion the previous year. "The rate of spend is expected to decline substantially thereafter," he told a mining conference in Barcelona on Tuesday, according to a transcript on the Anglo-Australian miner's website Wednesday. "By reducing our annual spend and increasing internal competition for capital, we expect to maximise returns from incremental investment, while delivering a substantial increase in the group's free cash flow." The company announced in February that Mackenzie would take over from Kloppers in May after BHP posted a 58 percent plunge in first-half net profit to US$4.2 billion, hurt by steep falls in commodity prices. Despite investing less, Mackenzie said he aimed to "grow the company more", voicing confidence the resources giant would enjoy better days as it focused more on iron ore, coal, petroleum and copper. "This is a wonderful time to be at the helm of the world's largest natural resources company," he said. "We believe our strategy, when combined with our great ore bodies, will deliver stronger margins throughout the economic cycle, a simpler and more capital-efficient structure, a substantial increase in free cash flow and growth in shareholder value." BHP shares were trading more than 2.5 percent lower Wednesday at Aus$33.78 in a generally weak market.

Global mining giant BHP Billiton has outlined plans to slash capital spending by almost a fifth, with new chief executive Andrew Mackenzie warning the brakes could be applied even further, AFP reports.

The world's biggest miner has seen profits hit by weak commodity prices and cool Chinese demand and in his first major address since taking over from Marius Kloppers, Mackenzie outlined a conservative approach.

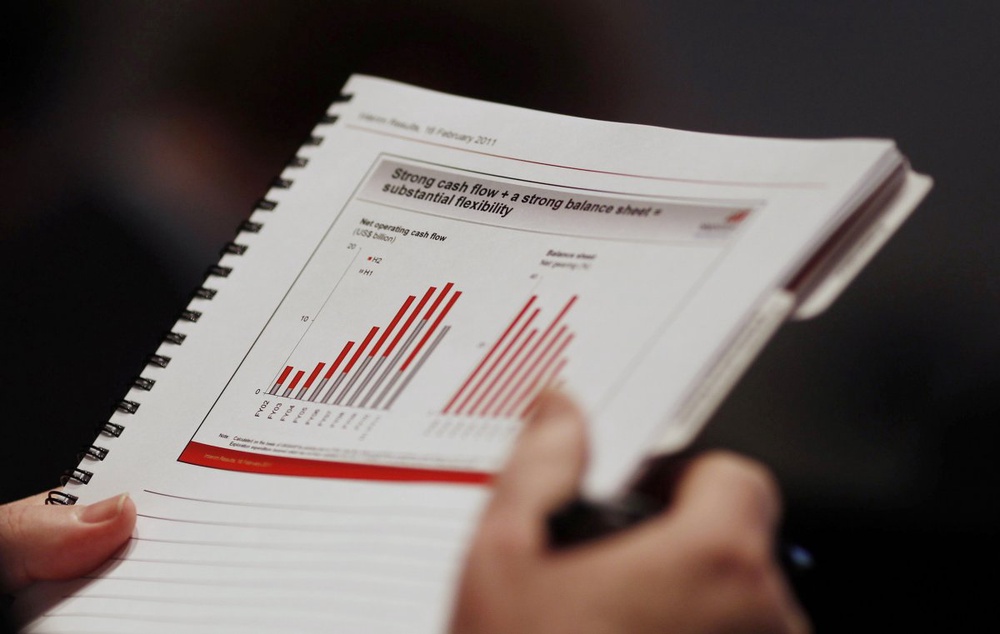

He said capital and exploration expenditure for the 2013/14 financial year would be cut to US$18 billion, from a peak of US$22 billion the previous year.

"The rate of spend is expected to decline substantially thereafter," he told a mining conference in Barcelona on Tuesday, according to a transcript on the Anglo-Australian miner's website Wednesday.

"By reducing our annual spend and increasing internal competition for capital, we expect to maximise returns from incremental investment, while delivering a substantial increase in the group's free cash flow."

The company announced in February that Mackenzie would take over from Kloppers in May after BHP posted a 58 percent plunge in first-half net profit to US$4.2 billion, hurt by steep falls in commodity prices.

Despite investing less, Mackenzie said he aimed to "grow the company more", voicing confidence the resources giant would enjoy better days as it focused more on iron ore, coal, petroleum and copper.

"This is a wonderful time to be at the helm of the world's largest natural resources company," he said.

"We believe our strategy, when combined with our great ore bodies, will deliver stronger margins throughout the economic cycle, a simpler and more capital-efficient structure, a substantial increase in free cash flow and growth in shareholder value."

BHP shares were trading more than 2.5 percent lower Wednesday at Aus$33.78 in a generally weak market.

+7 (777) 001 44 99

+7 (777) 001 44 99

Қазақша

Қазақша Русский

Русский English

English