Tengrinews.kz – An unusual new initiative for stores is being discussed in Kazakhstan, aimed at protecting consumers from hidden overpayments and making the market more transparent, according to Almaty.tv.

Currently, the law explicitly prohibits setting different prices depending on the payment method. That means a seller has no right to say: “It’s cheaper with cash, more expensive with a card.” The price of a product or service must be the same for everyone, regardless of how the customer pays. If a store does otherwise, it's a violation, and consumers can file complaints.

“If they charge a percentage for selling via cashless payment or in installments, that’s actually a type of activity that only banks are allowed to engage in. There’s no such thing as paying extra for installment plans — only banks have the legal right to do that,” explained Svetlana Romanovskaya, Chair of the Eurasian Consumer Union.

To prevent sellers from adding hidden markups, a dual pricing system has been proposed. In most cases, the overpayment for installments is not transparent.

Under the new system, the price tag will have two lines:

- The first shows the price for full immediate payment;

- The second shows the total cost if paid in installments.

This way, customers can decide for themselves whether they’re willing to pay extra.

Currently, stores and banks advertise such installment payments as "interest-free", but in reality, experts say an additional 15–20% is already factored into the cost.

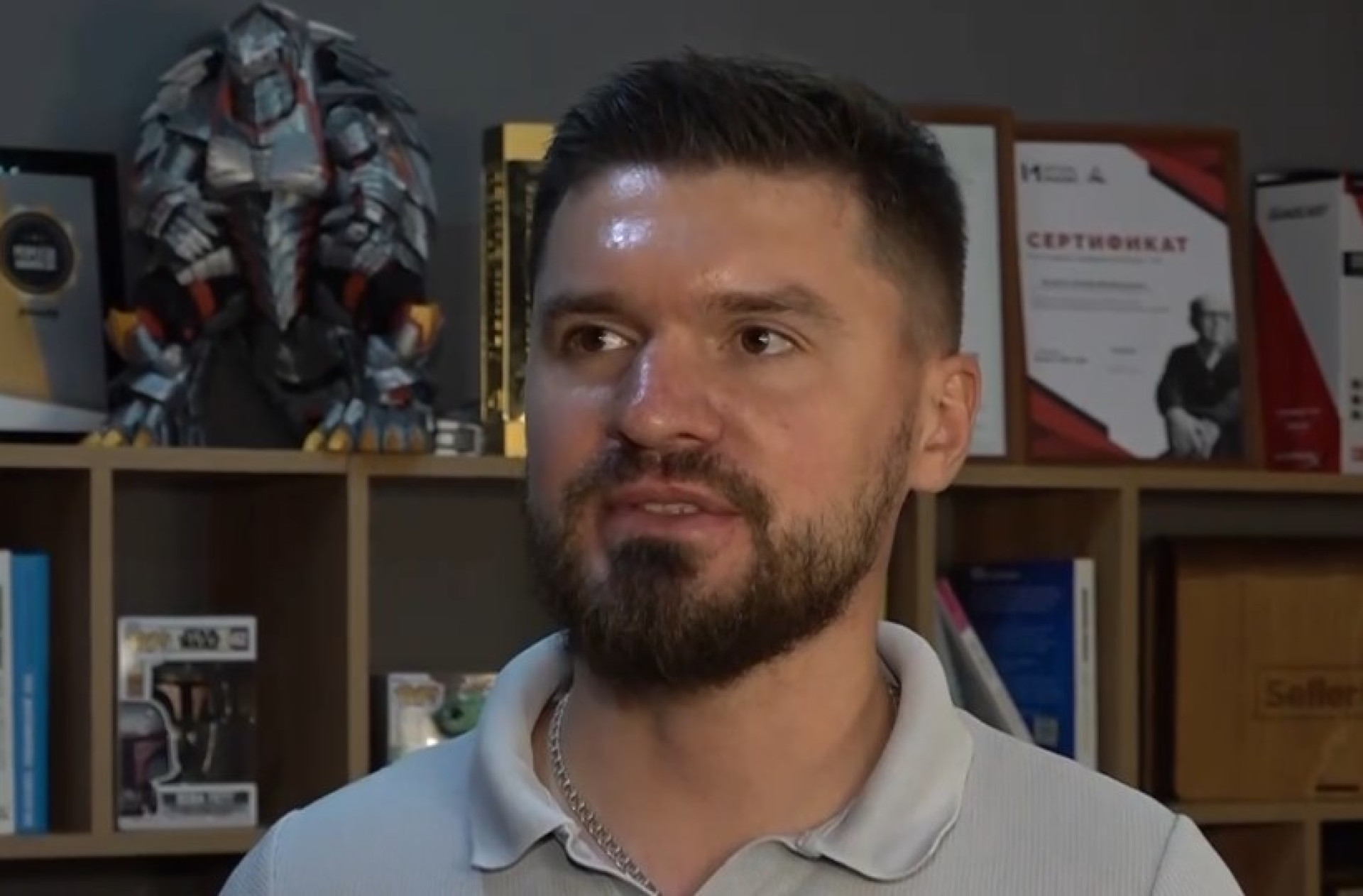

“This will initially be rolled out as a pilot project. We’ll see it in some stores, not in others. As I understand it, they’ll observe public reaction and finalize everything by the end of the year. On marketplaces, the commission is already built in — so there won’t be any visible difference between paying in installments or with cash. You just pay a commission to the marketplace as a seller, and then the bank will either make or lose profit from there,” said entrepreneur Artyom Bukhonin.

This approach allows buyers to assess the difference upfront and make a more informed decision. It's especially relevant now, as installment purchases have become widespread. Still, any new regulation in retail raises questions. Some see the benefit in dual pricing; others fear it will cause confusion.

Many people buy appliances, phones, or furniture this way, and not everyone realizes that the final cost might differ from the one displayed on the shelf.

Thus, the new initiative has nothing in common with the illegal “cash vs. card” pricing schemes. The goal here is completely different — to make pricing clear and transparent.