-- 2009 --

- October 16: Greece's incoming Socialist Prime Minister, George Papandreou, warns that his country's finances are in "a state of emergency."

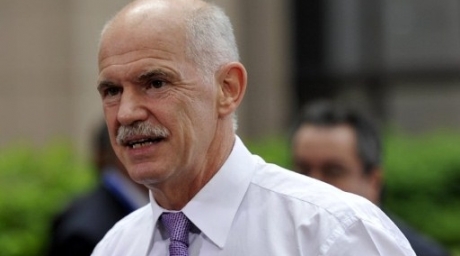

Greek Prime Minister George A. Papandreou. ©AFP

- December: The world's three main credit ratings agencies, Fitch, Standard & Poor's and Moody's, downgrade Greece's debt. Papandreou outlines massive public spending cuts.

-- 2010 --

- January 29: Spain announces a three-year austerity plan to save 50 billion euros ($71 billion) and reduce a public debt which reached 11.4 percent of GDP in 2009, nearly four times the eurozone limit of 3.0 percent.

- February 3: Greece adopts a savings plan, approved by the European Commission, which puts the country under surveillance.

- March 8: Portugal announces an austerity programme to reduce its record public deficit of 9.3 percent of GDP.

- March 30: Ireland pumps in billions of extra euros to prop up its troubled banking system.

- April 23: Shut out of the bond market by prohibitive interest rates, Greece appeals for financial help from the European Union and International Monetary Fund.

- May 2: Greece becomes the first eurozone country to receive a bailout as the EU and IMF announce a 110-billion-euro rescue in exchange for harsh austerity measures by the Greek government.

- May 5: Violent protests break out in Greece as anger at spending cuts boil over during a general strike. Three people are killed in a fire caused by a Molotov cocktail. Parliament adopts the austerity plan a day later.

Striking taxi drivers clash with riot police outside the transport ministry in Athens, Greece. ©AFP

- May 10: The EU and IMF create a financial stability fund worth 750 billion euros to serve as a lifeline for eurozone any nation in financial trouble.

- May 12-13: Spain and Portugal announce new austerity measures.

- July 29: Italy's parliament approves an unpopular austerity package totalling 25 billion euros aimed at bringing the public deficit under control and reassuring markets.

- September 30: Ireland's public deficit is revised to a record 32 percent of GDP, the largest deficit for a eurozone member since the euro was created in 1999 because of the funds it has had to spend propping up its broken banks.

- November 24: Ireland unveils a 15-billion-euro austerity package required to unlock an international bailout, slashing public sector pay and pensions, but refusing to raise corporation tax.

- November 28: The EU and IMF agree on an 85-billion-euro aid package for Ireland, with Dublin contributing 17.5 billion euros of the money by raiding its pension reserve fund and other domestic cash resources.

-- 2011 --

- March 23: Portugal's parliament rejects a new round of austerity measures, precipitating the fall of the minority socialist government.

- April 6: After resisting pressure to seek a bailout, outgoing Portuguese prime minister Jose Socrates finally asks for external help.

.jpg)

Portugal's Socialist Party candidate and caretaker Prime Minister Jose Socrates. ©Reuters

- May 5: Portugal agrees with the EU and IMF on a 78-billion-euro bailout in exchange for an austerity programme.

- June 24: Greek Prime Minister George Papandreou says his country needs a second bailout of similar size to the 2010 rescue.

- June 29-30: In Greece, parliament adopts 28.4 billion euros in budget cuts and tax hikes, as well as a privatisation programme, demanded by creditors in exchange for the release of the next installment of its 2010 bailout. Protests outside the legislature turn violent.

- July 2 and July 6: The eurozone and IMF clear the way for Greece to receive the next tranche of its bailout, 12 billion euros, and stave off imminent bankruptcy.

- July 11: Eurozone finance ministers agree to beef up their rescue fund, with a current lending capacity of 440 billion euros, to prevent debt crisis contagion. They put off a decision on a second bailout of Greece amid divisions over the participation of the private sector.

- July 14: Italy's borrowing costs soar to record highs as parliament rushes through radical budget cuts to stave off debt crisis contagion.

- July 21: Eurozone leaders gather for an emergency summit to reach an agreement on cutting Greece's debt, leaving open to the last minute the risk that it will default. Analysts warn it could be the last chance to save the eurozone.

@AFP